| 일 | 월 | 화 | 수 | 목 | 금 | 토 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 |

- 원의방정식 접선의길이

- 집합의연산법칙 합집합 교집합 여집합 차집합 서로소

- 점과 직선사이의 거리 내분점 외분점

- 명제 필요조건 충분조건 필요충분조건

- 연립방정식 부정방정식

- 합성함수 역함수

- 서울과고 경기과고 한과영 대전과고 대구과고 광주과고 세종과예영 인천과예영

- 서울과고 경기과고 한국과학영재학교 대전과고 대구과고 광주과고 세종과학예술영재학교 인천과학예술영재학교

- 인수분해 복잡한 식의 인수분해 복이차식 인수분해 문자2개이상인수분해

- 일차방정식 이차방정식 N차방정식 실계수이차방정식 유리계수이차방정식

- 애플워치8

- 직선의방정식 점과직선사이의거리 삼각형의넓이

- 탄천 종합 운동장 코로나 예방접종

- 유리함수 점근선 분수함수

- 나머지 정리 인수정리 조립제법

- 유리수 무리수 실수 실수의분류 이항연산 닫혀있다 실수의성질 절댓값 부등식성질

- 항등식 계수비교법 수치비교법 나눗셈원리

- 순열 원순열 중복순열 조합 중복조합

- 집합 원소 진부분집합

- 도형의자취 평행이동 대칭이동

- 복소수 실수부 허수부 복소수상등 복소수연산 켤레복소수

- 이차부등식 연립이차부등식

- 무리함수그래프

- 부등식의 증명 연립부등식 절대부등식 산술기하평균 부등식

- 근과 계수와의 관계 근의 부호

- 이차함수의 최대최소 산술평균 기하평균

- 일차함수그래프 이차함수그래프 절댓값그래프

- 판별식 실근 허근

- 경우의수 약수의개수

- 이차함수와 이차방정식 근의 분리

- Today

- Total

Math Family(천샘의 기하누설)

ENB 와 CNQ 분석 본문

-

Previous Close 39.13 Open 39.01 Bid 0.00 x 900 Ask 0.00 x 3100 Day's Range 38.81 - 39.22 52 Week Range 26.97 - 41.13 Volume 3,125,339 Avg. Volume 3,761,271 -

Market Cap 78.843B Beta (5Y Monthly) 0.95 PE Ratio (TTM) 16.37 EPS (TTM) 2.38 Earnings Date Nov 04, 2021 - Nov 08, 2021 Forward Dividend & Yield 2.67 (6.82%) Ex-Dividend Date Aug 12, 2021 1y Target Est 41.66

TipRanks

Fri, August 27, 2021, 12:54 AM

The ‘COVID year’ of 2020 was a rough one – markets got hammered, economies were shuttered, and we’re still recovering. But for a select few, last year brought success and opened up opportunities. Steve Cohen, the billionaire founder of Point72 Asset Management, took the difficulties in stride. In 2020, he increased his firm’s assets under management to more than $19 billion, and collected personal earnings of $1.4 billion.

Cohen has used his fortune to fund his philanthropy, as well as his purchase of the New York Mets baseball team. Sports fans may want to know his plans for improving the team’s roster – but market watchers are more interested in how he made that fortune. So following Cohen's purchases becomes a viable investment strategy for the rank and file.

With this in mind, we’ve opened up the TipRanks database to get the scoop on two of Cohen's recent new positions. These are Strong Buy stocks – and perhaps more interestingly, both are strong dividend payers. We can turn to the Wall Street analysts to find out what else might have brought these stocks to Cohen's attention.

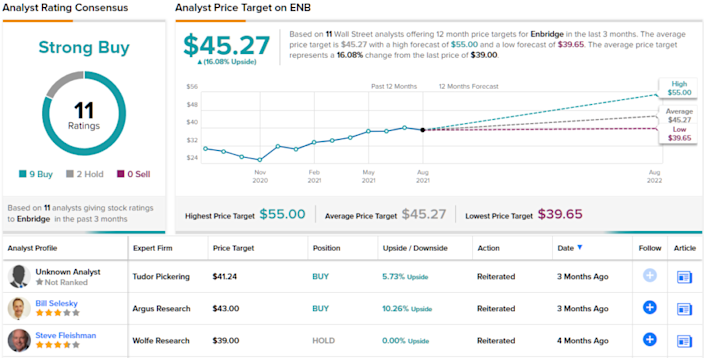

Enbridge, Inc. (ENB)

We’ll start with Enbridge, Canada’s largest natural gas distributor – and one of North America’s energy industry giants. The company controls 20% of the natural gas in the US consumer market, and has a 25% market share in the distribution of crude oil in North America. Continent-wide, counting by total consumer, Enbridge is North America’s third-largest natural gas utility. Enbridge has over 3,100 miles of pipelines, the largest such network in North America.

In the second quarter of 2021, Enbridge reported financial results with a mix of positive and negative factors, that were generally received as boding well for the company long-term. The company’s EPS came in at 55 cents, well above the 45-cent forecast, but well below the 65 cents reported in the year-ago quarter. Cash from operations also slipped, from $2.4 billion to $2.2 billion. At the same time, distributable cash flow – which the company uses to cover the dividend – rose modestly yoy from $2.4 billion to $2.5 billion. Enbridge reiterated its full-year earnings guidance, set at the $13.9 billion to $14.3 billion range.

On the dividend, Enbridge has a 66-year history of reliable payouts. The current payment is 83.5 cents per common share, and yields an impressive 7.1%. Over the past 26 years, the dividend has achieved a compound annual growth rate of 10%. This gives the dividend a high and sustained return, far in advance of Treasury bond yields.

As for Steve Cohen, his firm took a new position in Enbridge, buying up 484,233 shares of the company. This stake is worth over $18.9 million at current levels.

Analyst Todd Firestone, of Evercore ISI, sides with the bulls, reiterating an Outperform (i.e. Buy) along with a $55 price target. This target conveys his confidence in ENB's ability to climb ~41% from current levels. (To watch Firestone’s track record, click here)

Backing his stance, Firestone writes: “Mid-year and ENB looks to be checking most of the boxes you would expect, executing on named expansion projects, meeting targets on Mainline, progressing on L3, and basically seeing plenty of demand for use of their portfolio system-wide. Those certainly rank as positives, and having an immovable growth target that is basically free from commodity or production swings tends to frame the investment case at ENB."

The analyst summed up, "ENB’s offer of lower risk growth backed by structural demand for Western Canadian heavy is likely to underpin interest in our view."

Other analysts are also enthusiastic about the stock. Enbridge sports a Strong Buy consensus rating that breaks down into 9 Buys and 2 Holds. The average price target is $45.28 with an upside potential of 16%. (See ENB stock analysis on TipRanks)

Canadian Natural Resources (CNQ)

The second Cohen pick we’ll look at is another Canada-based energy company, Canadian Natural Resources. This company operates in Alberta and British Columbia, where the tar sands produce heavy crude oil and the mountain regions hold productive natural gas fields. Based in Calgary, at the heart of Canada’s energy production region, CNQ is one of the world’s largest hydrocarbon producers, and includes assets in the North Sea and offshore of West Africa.

In the second quarter of 2020, at the height of the corona pandemic, CNQ registered a net loss in earnings; over the past year, that has turned around to a strong net gain. The company’s EPS for 2Q21, of $1.30 per share, is a dramatic turnaround from the 26-cent loss of a year ago. At the top line, the $5.18 billion in revenue was up 127% year-over-year.

The big story here, however, has been the company’s cash flow. CNQ generated $2.94 billion in cash from operating activities, a massive gain compared to the year-ago quarter’s net cash loss of $351 million. This included $1.5 billion in post-dividend free cash flow. CNQ estimates full-year 2021 free cash flow in the range of $7.2 billion to $7.7 billion.

Solid cash flows fund a strong dividend. CNQ declared a payment of 47 cents Canadian (37.5 cents US) payable on October 5. At the current rate, this dividend annualizes to $1.50 per common share – and yields 4.8%. This compares favorably to the bond market, where the 10 year Treasure is yielding less than 2%.

This stock has been part of Point72's portfolio since 2014, but in the last quarter Cohen's firm added over 411,000 new shares to the stake, an increase of 114% in the holding. Point72 now holds a total of 774,398 shares of CNQ, worth US$25.15 million.

Wall Street agrees that CNQ is a buying proposition. BMO analyst Randy Ollenberger rates the stock a Buy, and his C$59 (US$46) price target indicated confidence in a 43% upside potential. (To watch Ollenberger’s track record, click here)

Backing his stance, the analyst wrote: “Canadian Natural’s industry-leading operating performance, cost structure, scale, and flexibility combined with its long life, low-decline, and high-quality asset base have translated into one of the lowest WTI break evens within its peer group... The company has very high insider ownership and benefits from widespread commodity price diversification that lowers its risk profile. We believe Canadian Natural will be able to further increase shareholder returns due to its strong ability to generate meaningful free cash flow, as well as pay down significant levels of debt.”

Overall, it’s clear that Ollenberger’s bullish view is mainstream for this stock. There have been 15 reviews from the Street, including 12 to Buy and 3 to Hold, for a Strong Buy consensus rating. CNQ shares are priced at US$32.3 and have an average price target of US$43.63, giving the stock a one-year average upside of ~35%. (See CNQ stock analysis on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

'재테크 > 주식 투자 알고 하기' 카테고리의 다른 글

| 토스, 모빌리티 스타트업 타다 전격 인수…한국판 '그랩' 노린다 (0) | 2021.10.09 |

|---|---|

| 한글과컴퓨터, 인도 HCL테크놀로지와 전략적 파트너십 체결 (0) | 2021.09.06 |

| 네이버 스마트스토어 '제로 수수료' (0) | 2021.07.24 |

| 현대차/기아차 2분기 매출 현대차 30조돌파/ 기아차는 영업익 10배 상승 (0) | 2021.07.23 |

| 인베이스/빗썸/바이비트 가상자산 거래소들 무더기 접속 장애~쿠팡도 에러~ 이유는 뭘까? (0) | 2021.07.23 |